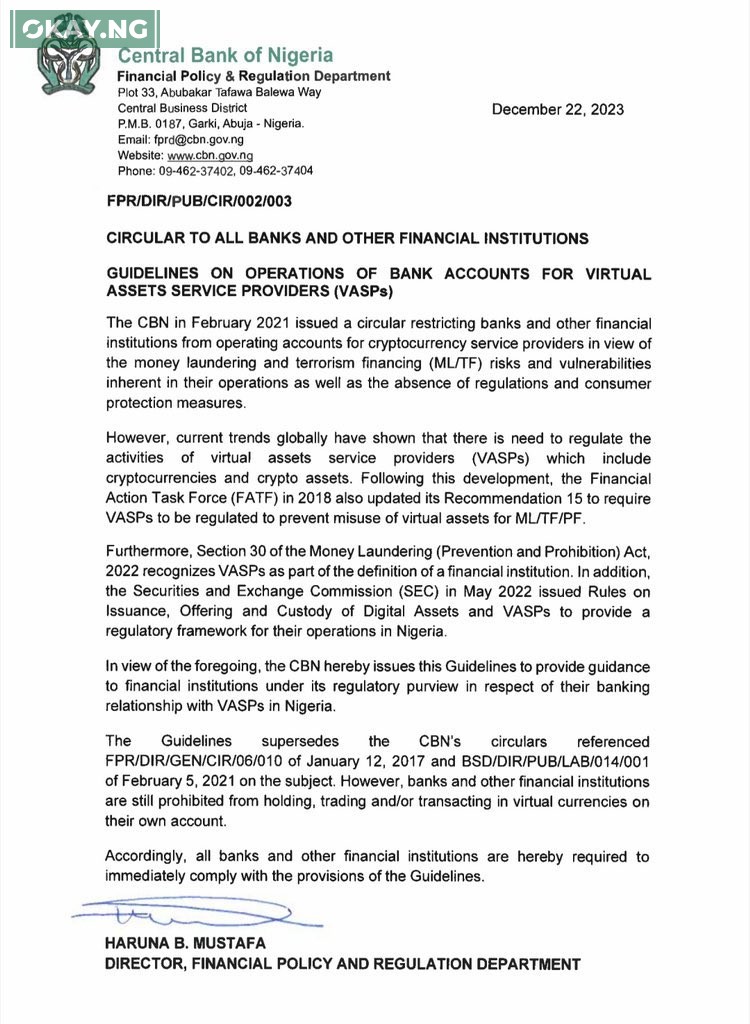

In a surprising turn of events, the Central Bank of Nigeria (CBN) has officially lifted its ban on cryptocurrency transactions, marking a significant departure from its previous stance.

The announcement, detailed in a circular dated December 22, 2023, comes with several important considerations that individuals, businesses, and investors in Nigeria should be aware of.

Here are seven things you should know concerning this trending development.

What Prompted the CBN’s Reversal on Cryptocurrency?

The circular acknowledges global trends in cryptocurrency regulation and emphasizes the need for effective oversight. The CBN cites concerns over money laundering, terrorism financing, and the absence of adequate consumer protection measures as key factors driving the policy shift.

What Role Does the Financial Action Task Force (FATF) Play?

The circular highlights the FATF’s 2018 update to Recommendation 15, urging the regulation of Virtual Assets Service Providers (VASPs) to prevent the misuse of virtual assets for illicit activities. This aligns with international efforts to combat financial crimes associated with cryptocurrencies.

How Does Nigerian Law Recognize Virtual Asset Service Providers (VASPs)?

According to the circular, Section 30 of the Money Laundering (Prevention and Prohibition) Act, 2022, recognizes VASPs as part of the definition of a financial institution. This legal recognition underscores the evolving nature of financial regulations in Nigeria.

What is the Securities and Exchange Commission’s (SEC) Role in this Shift?

The CBN mentions SEC’s issuance of rules in May 2022, providing a regulatory framework for the operations of VASPs in Nigeria. Understanding the collaboration between regulatory bodies sheds light on the comprehensive approach to cryptocurrency oversight.

How Does the New Guideline Differ from Previous CBN Directives?

The circular explicitly states that it supersedes previous guidelines issued by the CBN on the subject. It’s crucial to grasp the nuances of these changes, especially for individuals and businesses involved in cryptocurrency transactions.

Can Banks and Financial Institutions Engage in Cryptocurrency Transactions?

While the CBN’s new guideline allows for the operation of bank accounts for Virtual Assets Service Providers (VASPs), banks and financial institutions are still prohibited from holding, trading, and/or transacting in virtual currencies on their own account. Understanding the boundaries of engagement is vital for compliance.

Is Immediate Compliance Required?

The circular concludes with a call for immediate compliance from all banks and financial institutions under the regulatory purview of the CBN. Individuals and businesses involved in cryptocurrency-related activities should be aware of the urgency conveyed by the directive.