The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has voted to retain the Monetary Policy Rate (MPR) at 27.50%.

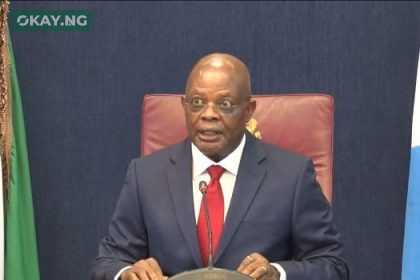

The decision was announced by CBN Governor Olayemi Cardoso at a press briefing on Thursday following the committee’s 299th meeting in Abuja.

Since the MPC began raising the MPR in May 2022, the committee has increased interest rates 15 times in an effort to curb inflation and stabilize the economy. However, the latest decision to hold the rate steady comes after the National Bureau of Statistics (NBS) reported a decline in Nigeria’s inflation rate to 24.48% from 34.8%, following the rebasing of the Consumer Price Index (CPI).

Cardoso stated that MPC members unanimously agreed to maintain the MPR at 27.50%, while also retaining the cash reserve ratio (CRR) at 50% and liquidity ratio at 30%.

“These include the stability in the foreign exchange market with the resultant appreciation of the exchange rate and the gradual moderation in the price of PMS,” he said.

However, the committee remains cautious about persistent inflationary pressures, particularly food prices.

**“Members, however, were not oblivious to the risk of persisting inflationary pressures driven largely by food prices.

“The committee noted the recent revision of the Consumer Price Index, CPI, by the National Bureau of Statistics, NBS, which reviewed the weights of items in the consumption basket to reflect current consumption patterns.

“The committee further noted that as the federal government continues to improve security in food-producing communities, supported by other measures to enhance food supply, food prices are expected to continue to moderate.”**

Cardoso emphasized the need for stronger collaboration between monetary and fiscal policymakers to ensure price stability and sustainable growth.

“The committee highlighted the benefits of the improvements in the external sector to exchange rate stability, including the convergence of rates between the Nigeria foreign exchange market and the bureau de change,” he added.

He also reiterated that the CBN must continue its market liquidity efforts while keeping a watchful eye on the banking system to mitigate external and internal risks.

Cardoso said the committee acknowledged CBN’s policies aimed at anchoring inflation expectations, easing exchange rate pressures, deepening financial inclusion, and improving monetary policy transmission.