Nigeria’s inflation rate has experienced a significant drop, landing at 24.48% year-on-year in January 2025. This dramatic shift follows the rebasing of the Consumer Price Index (CPI), a move that officials say provides a more accurate reflection of the nation’s economic landscape. The National Bureau of Statistics (NBS) unveiled the new figures on Tuesday, revealing a stark contrast to the 34.80% recorded in December 2024 under the previous methodology.

This news, while potentially offering a glimmer of hope, also raises important questions about the real impact on Nigerians’ daily lives.

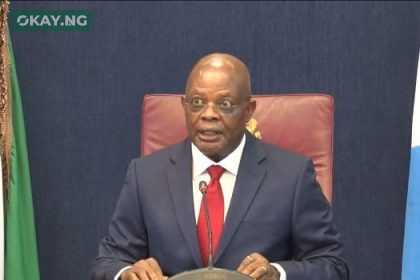

“The rebased inflation figures provide a more accurate representation of consumer spending patterns and economic realities in the country,” stated Adeyemi Adeniran, the Statistician-General of the Federation, during a press briefing in Abuja. This rebasing, a crucial statistical exercise, involves updating the reference year and revising the basket of goods and services used to calculate inflation. Essentially, it’s like recalibrating the economic compass to ensure it points true north. The previous index, it seems, had become outdated, failing to capture the dynamic shifts in consumer behaviour and market trends.

The January figures reveal urban inflation at 26.09% and rural inflation at 22.15%. While these numbers are still significant, they represent a considerable decrease from the previously reported figures. Perhaps most notably, the rebased food inflation index, a critical indicator given its impact on household budgets, now stands at 26.08%, down from a staggering 39.84% in December. This offers a potential sign of relief, though the real-world impact on food prices remains to be seen. Similarly, core inflation, which excludes volatile agricultural produce and energy prices, has also seen a decline, settling at 22.59%.

Read Also: Nigeria’s Headline Inflation Hits 34.80% in December 2024, Marking Fifth Year of Rising Prices

I can’t help but wonder, though, what this statistical adjustment means for the average Nigerian. While economists might celebrate the improved accuracy of the data, the lived experience of many suggests that the cost of living remains stubbornly high. While the numbers paint a more optimistic picture, the empty pockets and strained budgets of families across the nation tell a different story. This is where the human angle becomes crucial. We must ask: Does this statistical drop translate to more affordable groceries, cheaper transportation, or less financial strain on households?

The NBS’s rebasing of the CPI is undoubtedly a vital step towards ensuring the relevance of economic data. As Adeniran explained, “The previous base year did not adequately capture the changes in consumer behaviour, emerging market trends, and shifts in spending patterns over time.” This acknowledgement highlights the importance of regularly updating our economic tools to reflect the ever-changing realities on the ground.

However, the question remains: what now? While the numbers offer a sense of direction, the path forward requires more than just statistical adjustments. The government’s policies, including the Central Bank of Nigeria’s monetary tightening measures and fiscal interventions, will play a critical role in shaping future inflation trends. The real test lies in whether these policies can translate the statistical improvement into tangible benefits for the Nigerian people. Only time will tell if this statistical recalibration will lead to a genuine easing of the economic pressures felt by so many.