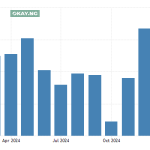

The digital payment ecosystem in Nigeria is witnessing a swift revolution, with Point of Sale (PoS) transactions surging to an unprecedented N18 trillion in 2024. This dramatic increase, a staggering 69% leap from the N10.7 trillion recorded in 2023, reflects a nation increasingly reliant on digital alternatives amidst a prolonged cash scarcity crisis.

“Fuelled by a protracted scarcity of cash at ATMs and the aggressive push in PoS deployments by fintech companies,” the Nigeria Inter-Bank Settlement System (NIBSS) data reveals. This shift is not merely a transactional trend; it signifies a fundamental transformation in how Nigerians conduct their daily financial lives.

While commercial banks traditionally dominated the PoS landscape, the emergence of fintech players has ignited explosive growth. The number of deployed PoS terminals more than doubled in 2024, soaring from 2.4 million to a remarkable 5.5 million, a 129% surge. This surge in deployment mirrors a parallel increase in registered terminals, jumping from 3.5 million in 2023 to 7.8 million in 2024.

“The initial motivation for PoS business was the lack of bank ATMs in some areas, this has shifted to the lack of cash in ATMs and the need to make cash available to Nigerians,” an industry analyst observed. This shift is palpable on the ground. Standing in front of an ATM dispensing “Out of Service” messages, one often finds a throng of PoS agents ready to facilitate transactions.

Fintech companies are leading this charge. Moniepoint, for example, has deployed over 800,000 PoS terminals across the country and is developing innovative all-in-one devices that integrate payment processing, inventory management, and transaction reconciliation. OPay, another major player, boasts a network of over 500,000 PoS agents.

Read Also: Legislature Moves to Enhance POS Security with Mandatory User Verification

Beyond individual convenience, this digital transformation has broader implications. “Aside from driving financial inclusion, the growing transactions on the platform are also boosting revenue for the Government through the Electronic Money Transfer Levy (EMTL) being charged on transactions from N10,000 and above,” highlighted an industry expert.

Okay Ng recently reported that Nigeria’s digital economy has taken a monumental leap, with e-payment transactions reaching an unprecedented N1.07 quadrillion in 2024, marking the first time e-payments have surpassed the quadrillion naira mark.

This staggering figure represents a 79.6% surge compared to the N600 trillion recorded in 2023. Based on the closing exchange rate of N1,535/$1 on December 31, 2024, this translates to approximately $702.6 billion in US dollars.

This surge in PoS usage underscores a broader trend. Nigeria’s electronic payment landscape is witnessing unprecedented growth. In 2024, electronic payment transactions reached a historic milestone, surpassing the N1 quadrillion mark for the first time, according to NIBSS data. This represents a remarkable 79.6% increase compared to 2023.

The NIBSS Instant Payments (NIP) platform, a cornerstone of Nigeria’s digital payment infrastructure, plays a pivotal role in facilitating these transactions. As the nation navigates a complex economic landscape, the rise of digital payments offers a pathway towards greater financial inclusion, economic growth, and a more efficient financial system.