The Association of Power Generation Companies (APGC) has issued a stark warning: Nigeria’s power grid is teetering on the brink of collapse. The immediate threat stems from a crippling N4 trillion debt owed by the federal government, compounded by stringent monetary and fiscal policies that are suffocating the sector.

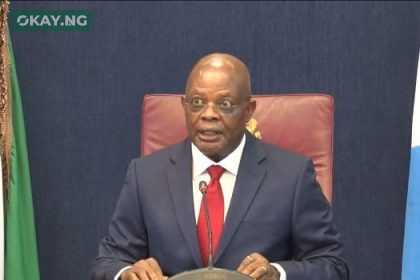

Sani Bello, chairman of the APGC’s board of trustees, revealed in a statement that the financial lifeline of the power generation companies (GenCos) is rapidly eroding. “The power generated by GenCos have continued to be consumed in full without corresponding full payment,” Bello stated, highlighting a systemic failure in the Nigerian Electric Supply Industry (NESI).

The staggering N4 trillion debt, comprising N2 trillion for 2024 and N1.9 trillion in legacy debts, has left GenCos in a precarious position. “GenCos are currently owed about N4 trillion… with no possible solutions, including cash payments, financial instruments, and debt swaps,” Bello emphasized.

The 2025 government budget, allocating only N900 billion to the power sector, has further exacerbated concerns. “This raises concerns about its adequacy to cover arrears and future payments,” Bello noted.

The liquidity crisis is not merely a financial headache; it’s a direct threat to the nation’s energy security. GenCos, responsible for generating the power that fuels Nigeria’s homes and industries, are struggling to maintain operations. The current payment structure, where other market participants receive priority payments while GenCos are left with residual amounts, has created a deeply unsustainable environment. As Bello explained, “GenCos only get paid a portion of their invoices (9 percent, 11 percent) from whatever amount is left. This is an aberration.”

The implications are far-reaching. “The situation has dire consequences for the GenCos and by extension the entire power value chain,” Bello warned. This isn’t just about numbers; it’s about the lights going out, businesses grinding to a halt, and the daily lives of millions of Nigerians being disrupted.

Read Also: Power Sector Grapples with N4 Trillion Debt, Fueling Industry Exodus

Furthermore, the sector’s reliance on foreign exchange for critical maintenance and operations adds another layer of complexity. “Access to forex is another problem, given that major operation and maintenance needs in the generation sub sector are dollarized,” Bello said, stressing the urgent need for a specialized forex window.

The APGC has put forward a series of urgent demands to avert the looming crisis:

- Immediate implementation of payment plans to settle all outstanding GenCos invoices.

- Reprioritization of payments under the waterfall arrangement to ensure full payment to GenCos.

- A clear financing plan to address exposures in the NERC’s Supplementary Order to the MYTO and the DRO 2024.

- Provision of payment security (guarantees) backed by World Bank/AFDB.

These measures, the APGC argues, are essential to “enable them to meet their critical needs, improve generation to Nigeria and implement their respective growth and expansion plans.”

The urgency of the situation cannot be overstated. “GenCos are of the position that the liquidity challenge threatening the continued operation of their power generation plants must be addressed urgently, and sustainably too,” Bello reiterated.

As someone who has followed the Nigerian power sector’s struggles, I understand the frustration and anxiety this situation creates. The promise of stable electricity has remained elusive, and the current crisis threatens to push the nation further into darkness.

The government’s response to these demands will be critical in determining the fate of Nigeria’s power grid. Swift and decisive action is needed to prevent a catastrophic shutdown and ensure that Nigerians finally have access to the reliable electricity they deserve.