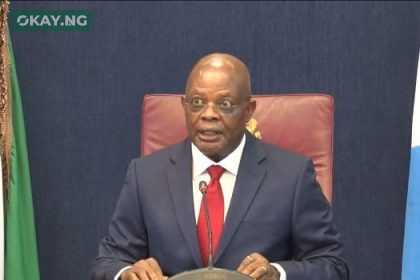

The ripple effects of increased tariffs imposed by the United States are sending shivers down the spine of global economists, with Nigeria potentially bearing the brunt, Central Bank of Nigeria (CBN) Governor Olayemi Cardoso has warned. Speaking after the 299th Monetary Policy Committee (MPC) meeting, Cardoso painted a concerning picture of how these trade restrictions, coupled with retaliatory measures from affected nations, could fuel global inflation and stifle economic growth.

“On the global scene… the adoption of increased tariffs by the new US administration against its trading partners and retaliatory tariffs may result in elevated inflation and tempered growth in 2025,” Cardoso stated, echoing concerns previously raised by the International Monetary Fund (IMF), which, despite maintaining its 3.3% global growth projection for 2025 and 2026, acknowledges the looming threat of trade disputes.

Cardoso also highlighted the ongoing geopolitical tensions, particularly the conflicts in Eastern Europe and the Middle East, as significant risk factors. These conflicts disrupt energy supply chains and global trade, further exacerbating inflationary pressures. “The war between Russia and Ukraine as well as the uneasy calm in the Middle East remain key risks to the growth outlook,” he explained, though offering a sliver of hope that resolutions might be on the horizon.

Here’s where it gets personal. As a news writer, I’ve seen firsthand how economic instability can impact communities. When prices rise, families struggle. Businesses face uncertainty. The CBN’s warning isn’t just about numbers; it’s about the livelihoods of millions of Nigerians.

The CBN, in its effort to combat inflation, has decided to hold the Monetary Policy Rate (MPR) at 27.50%, the Cash Reserve Ratio (CRR) for Deposit Money Banks at 50%, and for Merchant Banks at 16%, and the liquidity ratio at 30%. These measures aim to strike a balance between curbing inflation and maintaining financial stability.

Read Also: CBN Digital Finance Inclusion, Cardoso Economic Policy, Nigeria Recapitalization

This isn’t just an abstract economic theory. Think about the cost of your food items, the price of fuel, and the interest rates on loans. These are all directly influenced by inflation. If global prices rise due to these tariffs, Nigerians will feel the pinch. We’ve already seen how rising food prices, a major component of our current 24.48% inflation rate (as per the rebased CPI in January 2025), can impact daily life.

This isn’t just an abstract economic theory. Think about the cost of your food items, the price of fuel, and the interest rates on loans. These are all directly influenced by inflation. If global prices rise due to these tariffs, Nigerians will feel the pinch. We’ve already seen how rising food prices, a major component of our current 24.48% inflation rate (as per the rebased CPI in January 2025), can impact daily life.

However, monetary policy alone isn’t a silver bullet. Cardoso stressed the vital importance of coordinated fiscal and monetary policies. He emphasized the need for sustained efforts to improve food supply and security, addressing the structural issues that drive food inflation. This means investing in agriculture, improving infrastructure, and ensuring that food gets from farms to markets efficiently and affordably.

The recent US tariff hikes, targeting imports from China, Mexico, and Canada, ostensibly aimed at curbing illegal immigration and drug trafficking, could have far-reaching consequences. While the US government has its reasons, the potential for a global trade war, with retaliatory tariffs from other countries, poses a serious threat to the world economy and, crucially, to Nigeria. The human cost of such a conflict, in terms of lost jobs, reduced incomes, and increased hardship, cannot be ignored.

The coming months will be crucial. How the global economy responds to these tariffs and how effectively Nigeria implements its economic policies will determine the extent to which Nigerians are impacted. One thing is certain: we are living in uncertain times, and vigilance is key.